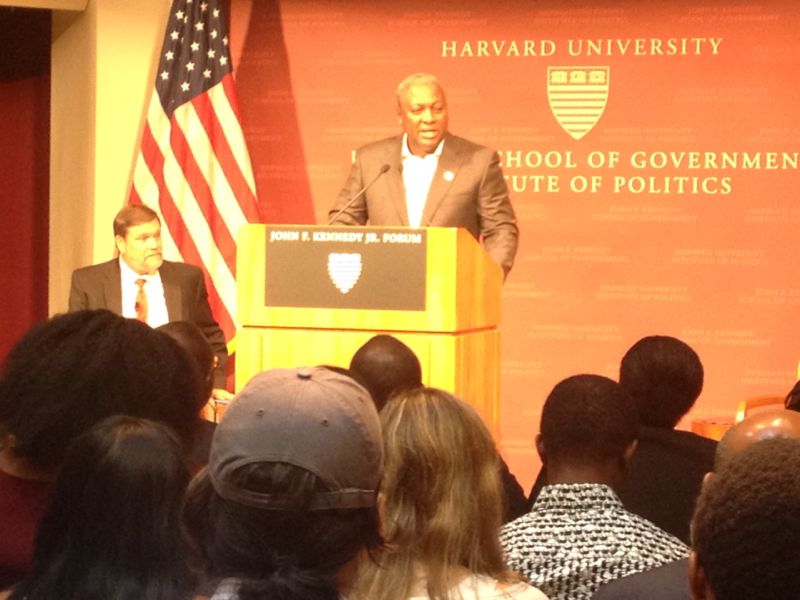

APJ caught up with President John D. Mahama on the occasion of his speech at the Institute of Politics at the Harvard Kennedy School. President Mahama discussed the leading causes behind Ghana’s economic challenges which, at their height early this year, saw inflation rates rise above 15 percent and a depreciation of nearly 40 percent in the value of the Ghanaian Cedi against the dollar.

The President pointed to three factors in his diagnosis of the problem: 1. An unsustainable public wage structure which resulted in the near tripling of the public wage bill over three years; 2. A decline in the prices of gold and cocoa (Ghana’s primary exports) which led to losses of $1.5 billion in revenue; 3. The growing costs of subsidies on petroleum products and public utilities.

President Mahama maintains however, that Ghana’s economic prospects are bright, as the country has rolled out a new Fiscal Consolidation Policy to reduce spending and increase government revenue. Furthermore, Ghana is currently negotiating the terms of a new stabilization program with the IMF which will likely boost international expectations of the country’s macroeconomic performance. Listen to the audio from our conversation with President Mahama here.

(Duration: 5 minutes)

It seems that Ghana may still have a long way to go, however, before its economy is fully in the clear. While the Cedi has surged against the dollar in recent months, inflation and interests rates continue to rise. Recent figures from Ghana’s statistics department show that inflation was up 2.7 percent in October reaching a high of 16.9 percent. Inflation is expected to remain beyond the 8 percent target at least until 2016. Just this month the Bank of Ghana raised interest rates from 19 to 21 percent in order to combat inflation, but this has spurred reactions from the Ministry of Trade which sees the high rates as unfavorable to the private sector. Both the Ministry of Trade and the Bank of Ghana have valid concerns, but the relevant question is: What should be the economic priority for Ghana right now? If the priority is to stabilize the economy and bring prices down, the Bank is doing what it must do. However, if the priority is to stimulate growth, then the Ministry of Trade’s warning against high interest rates is warranted. In the position that Ghana finds itself right now, both cannot be achieved in the short run and the future may yet hold more bitter pills for the country.